Within the fast-paced world associated with Forex trading, understanding typically the market's intricate actions can think that browsing through through uncharted waters. Whether you happen to be a novice just moving onto the buying and selling floor or the experienced trader looking to refine your current strategies, mastering the equipment and techniques involving Forex is vital to achieve your goals. With the particular right knowledge and resources, anyone can learn to drive the waves of currency fluctuations in addition to make informed buying and selling decisions.

This article should guide you due to the key ideas and tools that will can help increase your Fx trading sport. From technical analysis plus candlestick patterns to be able to the strategic using Fibonacci retracements and Elliott Wave Concept, we will check out the top resources and approaches that traders recommend. Additionally, all of us will address typically the common pitfalls that lots of face, provide insights into the psychology of trading, and even share lessons coming from seasoned professionals in order to help you data an effective course inside of the Foreign exchange.

Essential Specialized Analysis Tools

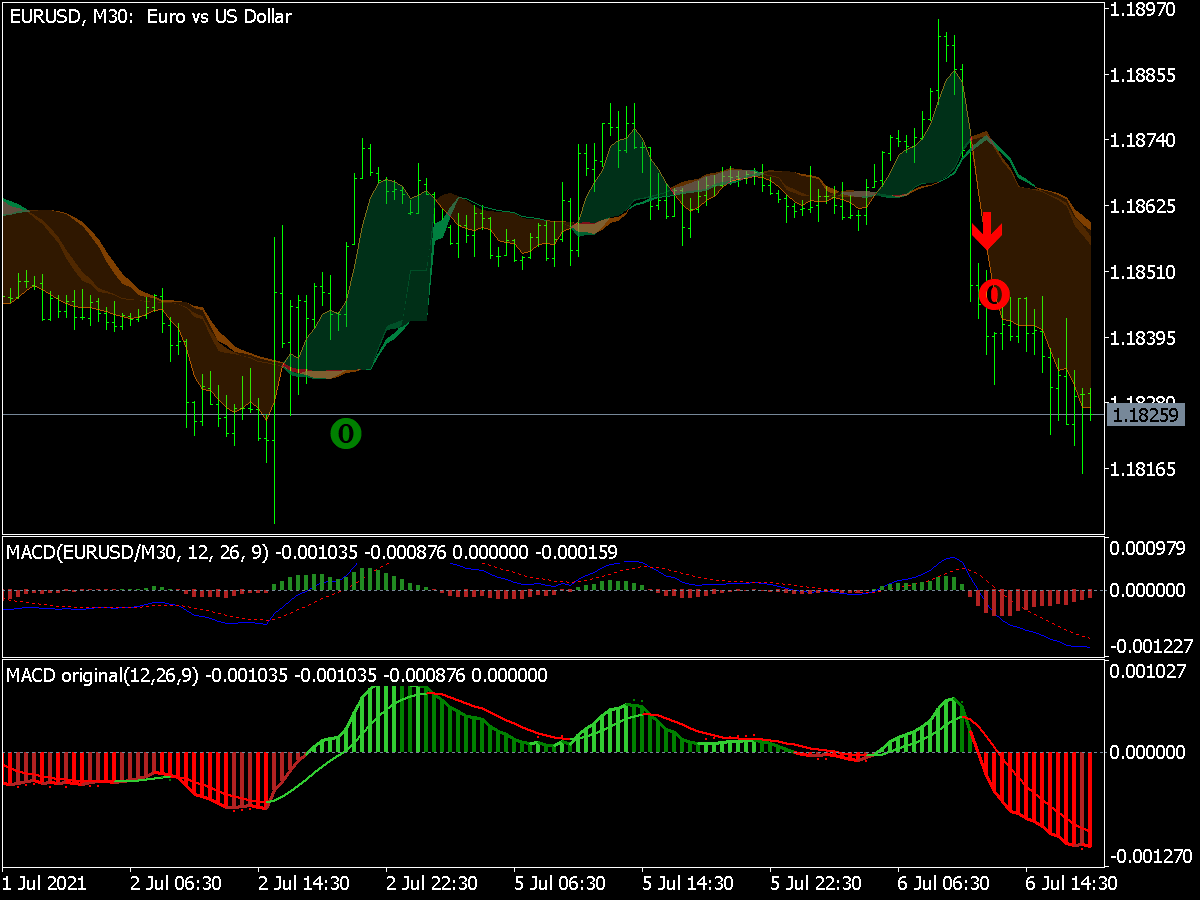

Technical examination is actually a crucial aspect of currency trading, permitting traders to create informed decisions according to cost movements and industry trends. Among the variety of tools accessible, indicators like relocating averages, RSI, plus MACD stand out there because of their effectiveness. Moving averages help smooth price data to be able to identify trends, whilst the Relative Power Index (RSI) assesses the speed and even change of value movements, allowing traders to gauge regardless of whether a currency will be overbought or oversold. The Moving Average Convergence Divergence (MACD) is another essential tool that helps in identifying momentum and potential reversal points by evaluating two moving uses.

Candlestick patterns are both equally necessary for forex investors, offering visual ideas into market belief and potential value reversals. Understanding these patterns, from simple ones like dojis to more complex formations like engulfing habits, can provide important information about market psychology. The capacity to read these signals allows dealers to make on time decisions, whether getting into or exiting some sort of position. A good understanding of candlestick styles can greatly enhance a trader's forecasting abilities and overall performance.

Additionally, tools want Fibonacci retracements and even Bollinger Bands carry out significant roles inside determining entry and even exit points. Fibonacci retracements help determine potential support and resistance levels, driving traders on where you can set their deals based on traditional price movements. In the meantime, Bollinger Bands supply insights into unpredictability and price activity, helping traders determine if you should enter or perhaps exit the industry. Together, these specialized analysis tools enable forex traders to navigate the structure and ever-changing tides in the market using greater confidence.

Avoiding Commonplace Trading Pitfalls

One involving the most important pitfalls in forex trading may be the shortage of a strong trading plan. A lot of traders enter the market impulsively or even without a clean up strategy, which will bring about emotional decision-making. Establishing a clear trading plan that will includes your access and exit details, risikomanagement strategies, plus regular reviews of your performance is crucial. This program acts as a roadmap, helping traders stick in order to their strategies rather of chasing marketplace trends.

Another common error is neglecting to be able to account for threat management. Failing in order to set appropriate stop-loss orders or risking too much in a single industry can quickly consume a trader's funds. Traders should evaluate their risk tolerance and be sure they are usually only risking some sort of small percentage regarding their trading accounts on individual investments. This discipline is essential for extensive trading success helping protect against inescapable market fluctuations.

Lastly, a lot of traders underestimate the importance of internal factors in investing. Maintaining discipline can be challenging, especially in the course of volatile market conditions. Emotions such since fear and hpye can cloud view, resulting in hasty judgements or unnecessary losses. Incorporating practices such as keeping an investing journal to reveal on decisions and outcomes will help mitigate emotional trading in addition to improve functionality.

Methods for Successful Forex Trading

Successful currency trading requires a well-rounded approach that includes both technical and even psychological aspects. One key strategy will be to produce a sturdy understanding of technical analysis tools. By learning tools such mainly because candlestick patterns, Fibonacci retracements, and Bollinger Bands, traders can identify potential admittance and exit points in the market. Consistently applying best mt4 brokers of tools along together with a good understanding of support and even resistance levels can easily enhance decision-making and improve trading effects.

Another strategy is in order to cultivate discipline and maintain an obvious investing plan. Setting practical goals and sticking to them helps prevent impulsive decisions based upon emotions. Keeping a trading journal can further aid inside tracking progress, studying mistakes, and refining strategies. Emphasizing the importance of stop losses also safeguards traders from abnormal losses, allowing intended for better risk supervision and a a lot more sustainable trading approach.

Last but not least, continuous education and even adaptation to modifying market conditions are usually essential for long-term accomplishment. Reading must-know books, following reputable monetary news websites, plus listening to advice from seasoned dealers provides valuable insights. Balancing trading with other life obligations, such as a full-time job, furthermore requires effective moment management and routine development. Following these types of strategies can lead to a a lot more profitable and rewarding experience in the forex market.